Dear maria,

We just published a new blog—please find the full text below. Translations coming soon. Firms’ Environmental Performance in Times of Crisis By Pierre Guérin, Fabio Natalucci, Felix Suntheim Leaders are often called upon to “rise to the challenge” in times of crisis. As firms and their leaders rise as best they can amid the ongoing health and economic crises, yet another crisis lies on the horizon. A looming environmental crisis, obscured by the exigency of the pandemic, requires action be taken by firms (and others). So how will business leaders and companies respond? Our latest analysis looks at past episodes of financial and economic stress to gauge the likely impact of the current crisis on firms’ environmental performance. On the one hand, the COVID-19 pandemic could increase awareness of environmental risks and bring about a shift in consumer preferences, corporate actions, and investor behavior that could accelerate the transition to a low-carbon economy. On the other hand, there is a risk that financially weakened firms, amidst heightened economic uncertainty, will reduce their investments in long-horizon, capital-intensive green projects, slowing down the transition. Past as predictor Looking at a large international sample of listed firms over the period 2002 to 2019, our analysis shows that the environmental performance of financially constrained firms is significantly weaker than for unconstrained firms. Our analysis incorporates various factors that commonly serve as proxies for financial constraints—smaller, unrated firms are more likely to be financial constrained than are larger firms with ratings. Similarly, firms that are financially constrained may be less willing to pay out dividends. Our main measure of environmental performance is a score based on various key performance indicators, such as resource usage; emissions reductions; and product innovation. For firms that do not pay dividends, are not rated, or are smaller, the environmental performance score is, on average, 10 to 30 percent lower than the score of large, dividend-paying, or rated firms. A shock with large macroeconomic and financial implications, such as the COVID-19 pandemic crisis, increases uncertainty and disrupts economic activity, a development that tends to amplify firms’ financial constraints. This, in turn, is likely to adversely affect firms’ green investments. As shown in our chart of the week, a sudden jump in global financial stress and uncertainty—comparable to the average level that prevailed in the first half of 2020—would lead to a drop in firms’ environmental performance, reversing gains made over the last decade. Critically, the pre-shock environmental performance level is not regained even three years after the shock. Similarly, our analysis found that when economic output declined, so too did firms’ environmental performance.  Present insight These results have important implications in the context of the COVID-19 crisis and the urgent need to reduce global greenhouse gas emissions: First, absent climate policy actions, such as a green investment push as called for in the recent World Economic Outlook, tighter financial constraints and adverse economic conditions can be detrimental to firms’ environmental performance, reducing green investments, and potentially slowing down the transition to a low-carbon economy. Therefore, to offset any potential deterioration in firms’ environmental performance, it will be crucial to put in place climate policies that alleviate firms’ financial constraints and aid green investment. Second, in addition to green recovery packages, policies aimed at fostering sustainable finance will be key: - Comparable, consistent corporate reporting on sustainability would enable a more effective assessment of firms’ environmental performance. Only accurate and adequately standardized reporting and disclosure will allow investors to determine actual exposures of companies to climate-related financial risks.

- It is important to instill confidence in investors that sustainability be not just an attractive label, but that it reflect underlying sustainable investment decisions. To achieve that, further standardization and clarification of what constitutes a sustainable investment fund is needed.

- International cooperation and a collaborative approach to the initiatives taking place globally are crucial to leverage efforts and to avoid fragmentation of sustainable asset markets. The IMF will be contributing to this endeavor.

*****

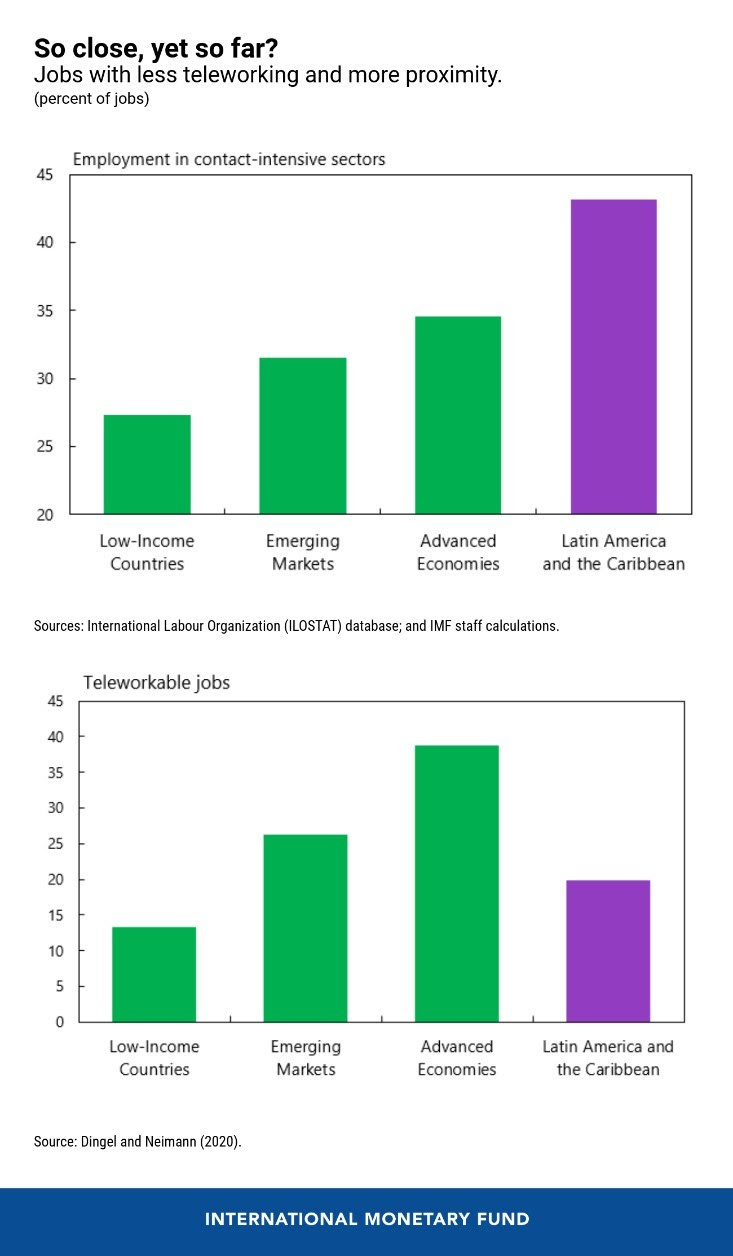

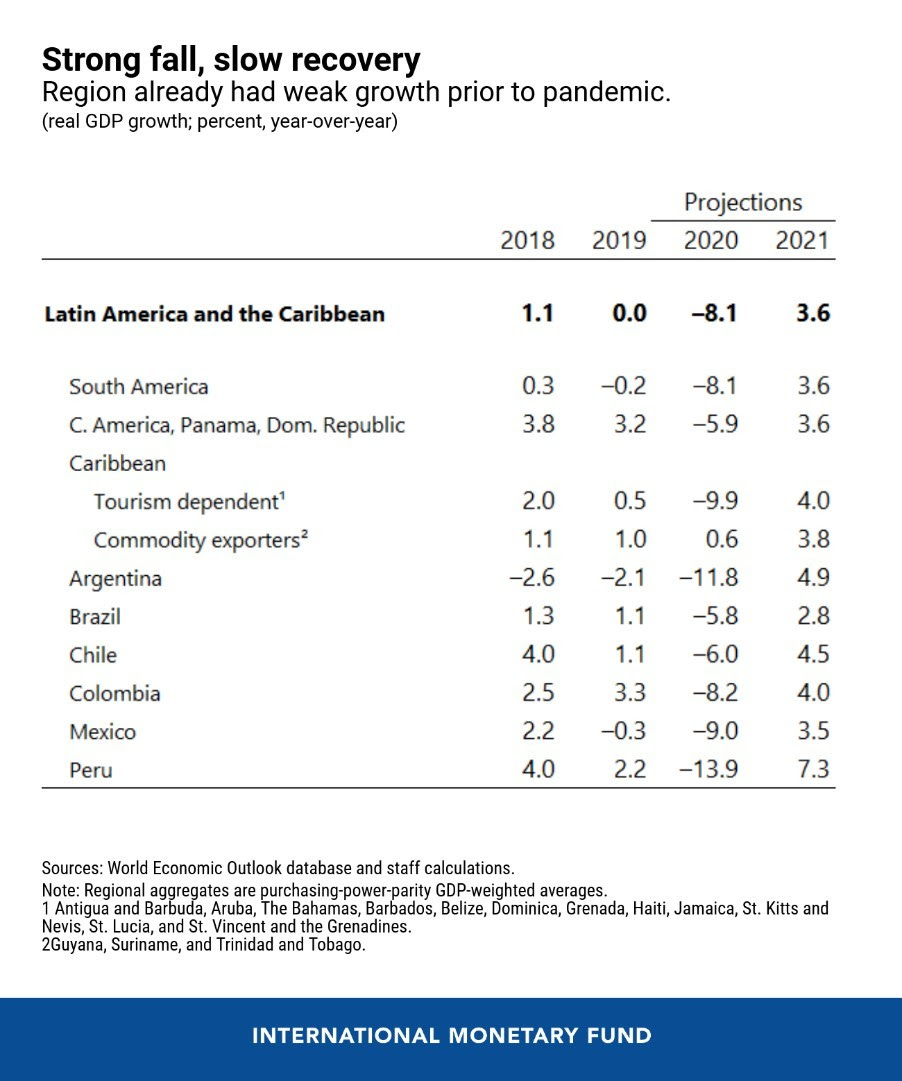

Watch the live press briefing on our latest Regional Economic Outlook for the Western Hemisphere featuring Alejandro Werner, Director, Western Hemisphere Department, IMF. Pandemic Persistence Clouds Latin America and Caribbean Recovery By Samuel Pienknagura, Jorge Roldós, and Alejandro Werner COVID-19 has hit Latin America and the Caribbean harder than other parts of the world, both in human and economic terms. The relatively large human toll is evident: with only 8.2 percent of the world population, the region had 28 percent of cases and 34 percent of deaths, by end-September. Our new Regional Economic Outlook: Western Hemisphere projects a real GDP contraction of 8.1 percent in 2020. Unlike in previous recessions, employment contracted more strongly than GDP in the second quarter of 2020, 20 percent on average for the five largest countries, and up to 40 percent in Peru. Two structural characteristics of Latin American and the Caribbean economies contributed to the relatively larger economic impact: comparatively more people work in activities that require close physical proximity, and less people have jobs in which teleworking is feasible. Almost 45 percent of jobs are in contact-intensive sectors (like restaurants, retail stores, or public transportation), compared to just over 30 percent for emerging markets. In reverse, only about one in five jobs can be done remotely, half the share of advanced economies and below the emerging world average (26 percent). These two features, in addition to a high degree of informality and poverty, and combined with lower trade and financial turbulence caused by the ailing global economy, contributed to the historic collapse in activity.

Uneven recovery… Economic activity started to rebound in May, aided by the gradual easing of lockdowns, consumers and firms adapting to social distancing, sizable policy support in some countries, and an improved external environment. Yet, the still high contagion and death rates have contributed to a relatively slow reopening process, due to persistent concerns over weak government capacity and resilience of health systems. Some countries (Brazil, Costa Rica, Uruguay) experienced less pronounced contractions and by July were back close to their January trends. Many, especially in Central America, were helped by a strong rebound in remittances and exports, together with low oil prices. Others, for example Ecuador and Peru, experienced relatively large collapses and activity still remained subdued in July.

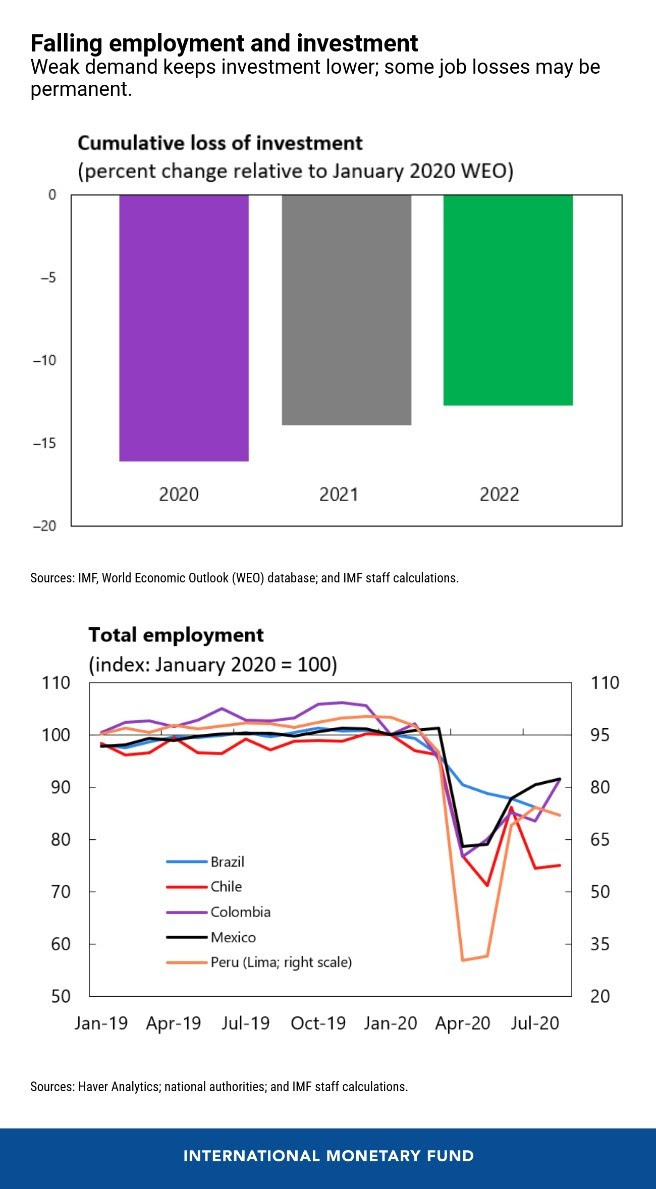

Dependent on tourism for anywhere between 20 to 90 percent of GDP and employment, Caribbean countries were the hardest hit. Despite being relatively successful at containing the virus spread, the sudden stop in tourist arrivals and local lockdowns was equivalent to a cardiac arrest to their economies. …With deep scars In the second quarter, Brazil, Chile, Colombia, Mexico, and Peru lost a combined 30 million jobs, with female, young and low-educated workers hit particularly hard. Although many jobs will be recovered as activity resumes, current estimates point to lasting income losses, potentially reversing some of the social progress achieved until 2015. Poverty is projected to increase significantly, exacerbating income inequality, already among the highest in the world before the pandemic. The recovery is expected to be protracted. Our forecast is for growth of 3.6 percent in 2021. Most countries will not go back to pre-pandemic GDP until 2023, and real income per capita until 2025, later than any other region. The outlook will be shaped by how the pandemic impacts external and domestic demand, and how the scars left by the crisis affect the region’s production capacity. The global economy’s long and uncertain recovery means a dim outlook for exports. Domestically, consumption of contact-intensive goods and services will likely be depressed until the pandemic is controlled, and income levels might stay subdued even afterwards. The resulting weak demand and uncertainty will hold investment back over the medium term. Some job losses might become permanent, reducing potential growth, especially where fiscal support has been timid.

Policy priorities Bold policy actions by many governments were critical in mitigating the pandemic’s economic and social impact but leave a legacy of higher public and private debt. Policies should remain focused on containing the pandemic and cementing the recovery. Premature withdrawal of fiscal support should be avoided. However, further support should be accompanied by explicit, legislated and clearly communicated commitments to consolidate and rebuild fiscal defenses over the medium term. Once the pandemic is under control and the recovery is underway, these commitments will need to be executed, entailing strengthening of medium-term anchors. Fiscal structural reforms should also aim at enhancing automatic stabilizers, social safety nets and access to health and education, while preserving public investment. Financial regulation will need to address the potential financial stability risks emerging from the crisis. The share of corporate debt at risk (when earnings are lower than interest expense), has doubled from 14 percent last December to 29 percent in June, and could rise more in 2021, in an adverse scenario. Debt restructuring will be critical to recover the financial health of viable firms. For unviable ones, efficient and equitable bankruptcy frameworks that distribute losses between investors, creditors, owners, workers, and the government will be needed. Despite the deterioration in corporate balance sheets, Latin American banks remain resilient. Banks entered the pandemic on a relatively strong footing, with ample capital and liquidity buffers, and low nonperforming loans. Most would be able to maintain required capital ratios, even in a worsening scenario. However, as activity recovers, banks will need to rebuild capital to ensure medium-term financial stability. Countries should monitor the weaker institutions in case a persisting pandemic causes a more protracted and severe recession. A weaker-than-expected recovery and a more persistent pandemic will impose more difficult choices for governments. Scarring and lower potential GDP growth add to the short run policy challenges. While some structural reforms may support confidence and the recovery, especially if they manage to lay the foundations for more sustainable and inclusive growth going forward, the legacies of the pandemic cloud an already uncertain outlook for the region.

Thank you again for your interest in IMF Blog. Take good care, |