The IMF and the Greek Crisis: Myths and Realities

September 30, 2019

Good evening. It is my pleasure to be here. I would like to thank the Hellenic Observatory and professor Featherstone for the invitation and you all for coming.

Let me make a few caveats at the outset:

First, while my discussion of the IMF’s role in Greece will draw conclusions about outstanding issues, I will not discuss the new government’s program. That would be premature.

Second, this is not a comprehensive review. I address three key issues: the fiscal adjustment, the reasons for the unexpected deep recession and the sovereign debt issue. I ignore other important issue, like financial sector issues. And these are personal views, not official IMF views. You can find a more comprehensive review in our Independent Evaluation Office’s report.

Third, I will focus mainly on the criticism of the program, on what went wrong, at the risk of appearing excessively negative. The fact is that Greece has undertaken important reforms. We should recognize this, and the significant hardship endured by the Greek people.

Fourth, our last disbursement was in mid-2014, because of disagreements since then, first with Greece on policies and then with European partners on debt. In that sense we were out for half of the period of Greek programs. But we have participated in the discussions throughout.

Where is Greece now

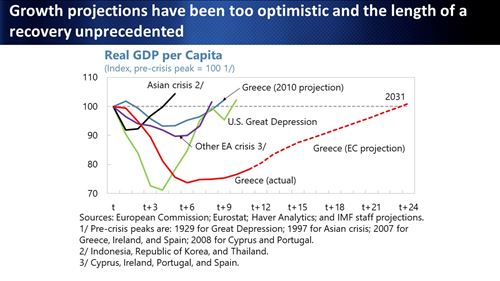

Let me begin with a snapshot of where Greece stands today. When designing the program, we realized that the need for a sharp internal devaluation would cause a deep depression. In terms of GDP per capita, we assumed that it would take Greece 8 years to return to pre-crisis level. This was as bad as in the United States Great Depression’s in the 1930s, and considerable worse than the four years that it took countries affected by the Asian crisis.

The outcome was much worse. Today, almost ten years later, GDP per capita is still 22 percent below the pre-crisis level. We forecast that it will take another 15 years, until 2034, to return to pre-crisis levels. Under the Commission’s forecast it will take until 2031.

The Fiscal Adjustment

The Euro Crisis originated in the mis-management of the monetary windfall enjoyed by countries in the periphery when they adopted the euro. In Ireland and Spain—and to some extent Portugal—this windfall fueled an unsustainable demand boom mainly through the private credit channel. In Greece, it took place almost entirely through the fiscal channel, in particular through a surge in public pensions, but also in other transfers and wages.

Pensions and social transfers increased by a whopping 7 percent of GDP from the time of euro adoption to the eve of the crisis, while the public wage bill rose by 3 percent of GDP. This drove the overall fiscal deficit from 4 percent in 2000 to more than 15 percent of GDP in 2009—a staggering five times the Maastricht limit.

Unsurprisingly, therefore, Greece faced fiscal consolidation to a much larger extent than other crisis countries. I will get to the debt issue later but let me stress already here that with a primary deficit of about 10 percent of GDP in 2009 no amount of debt reduction would have prevented a heavy dose of “austerity”.

The original program foresaw fiscal adjustment of more than 12 percent of GDP over 3 years. Although not unprecedented, this was ambitious by international comparisons and especially in view of Greece’s track-record. A less ambitious path would have required more financing. But with financial support already way above anything seen before anywhere in the world, and with European partners being forced to break in a spectacular way their no-bail-out mantra for a country that was considered to have mislead them, there was no support for being less ambitious.

This also meant that the deeper-than-expected recession forced significant additional fiscal measures from 2011. With no more low-hanging fruits, the quality of the measures began to deteriorate. We became increasingly concerned that the adjustment—while extraordinary—was being achieved in a growth unfriendly and unsustainable way.

What do I mean? Capital spending and recurrent spending other than wages and transfers have been cut to levels that hamper potential growth and the provision of public basic services. On the revenue side, an increase in already high tax rates levied on a narrow bases has contributed to a dramatic further deterioration in already low current tax collection rates, from 65 percent in 2010 to about 41 percent in 2017.

This reflects mainly lack of political support for reforms to reduce pensions to sustainable levels and broaden the tax base.

Pension reforms keep on being reversed. Most recently, the 2016 alignment of the exiting retirees’ benefits with the new unified pension formula has been cancelled. As you see, the deficit in the pension fund remains extremely high compared to other European countries and the recent cancellations mean that further reduction will be slow.

As to the personal income tax, the exemption threshold relative to the average wage is more than two times higher than the European average, exempting well over half of wage earners and pensioners. Unfortunately, the 2017 broadening of the base pre-legislated for 2020 was similarly scrapped as soon as the ESM program lapsed.

Fundamentally, Greece is still providing levels of pensions comparable to the richer European countries without the same level of European middle-class taxation. Without pension and personal income tax reforms, it will be very difficult to undertake growth friendly spending and tax reforms critical to long-term growth prospects.

Finally, a comment on public perceptions of our fiscal policy advice. We have often been wrongly accused, including by the Greek authorities, of advocating more austerity. This caused some frustration within the IMF already from 2012, when we belatedly—I will get to this—argued for lower surpluses.

Our frustration was much larger in recent years when our call for pension and tax reforms to make room for growth-friendly measures was portrayed as a call for more austerity. The government actually deliberately over-performed relative to the ambitious 3.5 percent of GDP target agreed with European partners in order to convince them that Greece could afford to reverse the pension and tax reforms. It undertook more growth-damaging austerity than advocated even by the Europeans to avoid the growth-friendly reforms advocated by the Fund.

The Reasons for the unexpected deep recession

Let me turn to the reasons for the much deeper than expected output contraction.

I agree that we initially under-estimated the fiscal multipliers and therefore the impact of the fiscal consolidation on GDP. But the quarterly program reviews relatively quickly allowed us to modify the multipliers and acknowledge that additional financing and a longer adjustment period would be required.

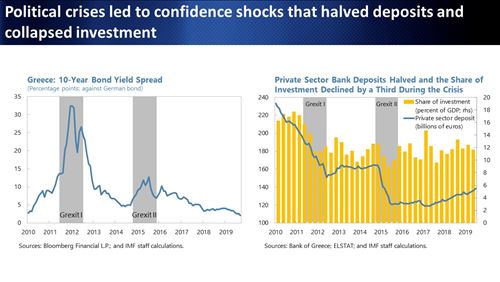

These downward revisions might have contributed to dissolution and fatigue. In that sense, the initial under-estimation might have contributed to the deepening political crisis that soon began to take a toll on confidence and economic performance. But the root cause of this crisis lies deeper and cannot simply be explained by under-estimation of multipliers.

Contrary to other crisis-hit countries, there was no broad political support for the program from the outset. It was opposed from the start by the main opposition party, and soon also by the old-guard within the ruling party. By end-2011, European leaders had lost confidence and, in exasperation, finally broke the exit-taboo, telling the main parties to unify behind the program or accept the consequences. The Papademos and Samaras government did so, but the political fragmentation continued, leading to the virtual collapse of support for the traditional parties that culminated in the coming into office of SYRIZA in 2015.

Doubts about support from Greece’s European partners made things worse. This is important: we cannot just put the blame on the Greek political system. While Europe had shown considerable political commitment to Greece by admitting it to the Euro in 2000—there were many voices that had argued at that time, rightly or wrongly, that this was a case of politics trumping economic logic—there was evidently much less political support for Greece by 2010. This, and mounting concern about broader euro area architecture, caused growing doubts about Greece’s ability to avoid Grexit.

From early 2011, the quarterly reviews of the program had to internalize a constant deterioration in sentiments as the deepening political crisis in Greece and the steadily more vocal skepticism in Europe continuously fed on each other. The result was a dramatic flight from the banking system and virtual collapse in investments. It is not surprising in view of this that there was a continuous and deep contraction in GDP.

An interesting comparison here is with the 2011 program with Portugal, which was structured along similar lines as the Greek program, with largely the same multipliers, although there were obviously design differences. While negotiating the Portuguese program with the sitting government, we had—with its knowledge—parallel discussions with the main opposition party, and the program was approved with broad political support. When the government changed a few months later, implementation continued seamlessly. The broad political support behind the Portuguese program both—in Portugal and abroad—you never heard calls for Portugal to exit—was the main reason for why it fared so much better than the Greek program.

Fundamentally, the Greek crisis was as much, if not more, a political than an economic crisis. While the reasons are complex—going well beyond the scope of this presentation—the weaknesses of the Greek political system and its economic policy-making institutions and the power of vested interests could surely not have come as a surprise to veteran European policymakers. Neither should the flaws in the European architecture.

However, saying that the Greek crisis was as much a political as an economic crisis does not relieve policy-makers, including the Fund, of responsibility for the malaise that followed. It is legitimate to ask if we were not too sanguine about the Greek political system’s ability to implement a program that would require fiscal adjustment of more than 12 percent of GDP over a short period, instigate a significant internal devaluation, and take on deeply entrenched vested interests opposed to the reforms. In retrospect we surely were.

For instance, while the initial assumption in the debt sustainability analysis—the DSA—that Greece could reach a primary surplus of 5-6 percent of GDP might be in line with what has been seen in some other cases, it proved far too optimistic in the Greek reality. This was also the case with the DSA assumption of privatization receipt of €50 billion. Such optimistic assumptions made us initially under-estimate the debt problem.

Particularly important, too -optimistic assumptions about reforms made us not only over-estimate the supply response, but it also resulted in an excessive burden being placed on labor, contributing to a sense of unfairness and attendant loss of support for the program.

Thus, the Fund was rightly supportive of the 2012 labor market reforms. The reform of collective bargaining to better align wages and productivity at the enterprise level and the lowering of Greece’s exceptionally high minimum wages improved competitiveness.

The problem was, however, that the programs were much less successful in opening up markets for goods and services. Contrary to labor markets, reforms of closed professions and opening of goods and services markets involve a huge number of small changes, which multiply difficulties in overcoming the resistance of vested interests.

Thus, salaries were adjusted, but the increased competition that should have helped to bring prices down never happened. The burden of the internal devaluation fell excessively on labor.

Thus, we did get important things wrong initially because we misjudged support for the program—in Greece and abroad. But the program was gradually modified in the context of quarterly reviews. The DSA assumptions became much more realistic and large-scale debt relief was belatedly provided—I will get to this in a moment. And, as mentioned, Greece was given more time to undertake fiscal consolidation while European partners accepted to provide support on a truly exceptional scale—ultimately reaching about 140 percent of GDP—in order to fit the Greek reality. Greece was given more time but accepted continued painful fiscal adjustment.

Such a dynamic is not uncommon to IMF program. We work under extreme uncertainty, not least political, and circumstances constantly involve. Programs must organically adjust to such changing realities. Greece and its European partners endured in the end—doing what was needed after several iterations to keep Greece in the euro area.

The debt Issue.

Finally, I turn to the debt issue.

We have often been criticized for having supported a bail-out back in 2010, rather than bailing-in creditors, at the expense of leaving Greece with an unsustainable debt burden.

Remember, this was only 18 months after Lehman—financial systems were still reeling from the Global Financial Crisis. Most important, there were no firewalls to prevent contagion to other vulnerable euro area countries.

Remember also that the Fund has not only a responsibility vis-à-vis the member facing default, but also with the membership at large. Concerns about systemic instability will always be part of the IMF’s deliberations. Such concerns loomed very large in 2010.

As you can see, when the bail-in of private creditors—the PSI, or Private Sector Involvement—finally came in early 2012, it was tough by any comparison. An even tougher PSI would have significantly increased the risk of it being considered coercive, with an attendant risk of much larger holdouts, litigation, and contagion.

Would it have made a major difference if this PSI had come already at the outset? All other things being equal, debt-to-GDP would have been lower by some 18 percentage points of GDP. While this is not a large difference considering that the debt-to-GDP ratio peaked at 181 percent, “all other things” would not have been equal. The lower debt would have enabled some limited easing of the fiscal adjustment. More important, it would presumably have had a positive impact on sentiments, by lessening the sense of unfairness and loss of public support caused by the bail-out of foreign creditors.

If we had had the ESM and the European Central Bank’s Outrught Monetary Transactions back in 2010 to stem contagion, an earlier PSI would surely had been desirable. But it would not fundamentally have prevented the adverse debt dynamics that began to emerge as a result of the much-larger-than expected output contraction.

The deepening recession soon made it clear that PSI alone would not be sufficient—and that Official Sector Involvement—OSI—would also be required.

As you know, the controversy here is that Greece’s European partners insisted on avoiding nominal haircuts, and on providing debt relief by reducing the net present value—NPV—of their claims through large reductions in interest rates and lengthening of maturities. While the Fund did prefer haircuts, we accepted back in 2012 that the provision of OSI through the NPV route did provide a meaningful alternative.

The dramatic lengthening of maturities and reduction in interest rates—which gave Greece AAA interest rates averaging around 1.8 percent and eventually the best maturity profile of any advanced country exceeding 20 years on average—produced a significant easing of the debt burden. As you see, interest payments fell from €12 billion in 2009 to about %6 billion or 3.3 percent of GDP in 2018, taking the average interest rate much below other highly indebted vulnerable countries like Spain, Portugal and Ireland.

By end 2014, Greece had regained some access to capital markets and the view was beginning to take hold that the Europeans—who had committed to provide more relief if needed—might not have to do so.

As you know, the situation deteriorated rapidly again when the SYRIZA government abandoned large parts of the program in early 2015, causing a further contraction in output and triggering the second Grexit crisis. Projected debt-to-GDP ratios shot up, and significant additional debt relief became necessary.

The Fund accepted to continue to rely on NPV-improving measures. But with interest rates already close to the ESM’s AAA rate, this would require a dramatic lengthening of the already long maturity profile, well beyond what normally is considered maximum terms. But such generous terms proved politically unacceptable for the Eurogroup in view of the political animosities that were unleashed by Greece’s dramatic policy-reversals in 2015.

In the end, the Fund concluded that while the additional OSI that was provided improved medium-term debt sustainability, there were still significant long-term risks. Our concern was that the private sector will not take back on its balance sheets—at an interest rate consistent with debt sustainability—the huge amounts of official debt falling due according to the current schedule. Thus, we could not reach agreement and the ESM program went ahead without an accompanying IMF program.

This being said, debt sustainability might not be as serious a concern as it once was. The fact is that the Europeans have—at the end of two serious episodes of Grexit fears—ended up showing an extra-ordinary commitment to Greece. And Greece has shown an equally extra-ordinary commitment to do whatever it takes to unlock European support. I can understand why potential investors are not too concerned about debt sustainability at this juncture.

Looking back, while the bail-out in 2010 was justified by systemic concerns, this in retrospect entailed a transformation from private to public debt that greatly politicized the debt issue. In view of the downside risks, one could argue that we should have sought a commitment by creditors to stand ready to give debt relief if such risks materialized and insisted that it should take the form of haircuts. We did not because we did not foresee the degree to which the escalating crisis between Greece and its European partners would politicize the debt issue.

Concluding remarks

It is time to conclude.

Contrary to other main reserve currencies, the euro area is not a political union. When a Greek minister rightly complaints to colleagues from other sovereign countries at the Eurogroup about painful cuts to pensions and minimum wages, sympathy will be tempered by the fact that many countries around the table pay even lower pensions and wages. When a Greek minister appeals for better financing terms, many colleagues will remark that they face much less favorable terms. When we argue that Greece should limit its primary surplus to 1½ percent of GDP, the reply is that several other countries have to aim higher.

In the end, the Eurogroup has to strike political compromises, and sometime these compromises are difficult to reconcile with the IMF’s rules-based system and our need to apply uniform standards across our membership. In the early years of the Greek crisis, when there were acute systemic risks, it was easier for the Fund to work within the limits arising from the special political features of the euro area, but as such risks have subsided this clearly proved more difficult.

After many iterations, involving politically difficult decisions by both Greece and its European partners, Greece has achieved a considerable measure of macroeconomic stability. A modest recovery is underway, unemployment is declining, real wages are recovering, sovereign yields are much lower, and capital market access is slowly being restored. But pervasive rigidities still weigh on productivity and—as noted at the outset—Greece still has a very long way to go for incomes merely to catch-up to per-crisis levels. Greece now has the breathing space to implement the fundamental reforms needed for it to prosper within the euro area.

Thank you for listening.