| The latest IMF analysis of global economics, finance, development and policy issues shaping the world // |

|

| |||

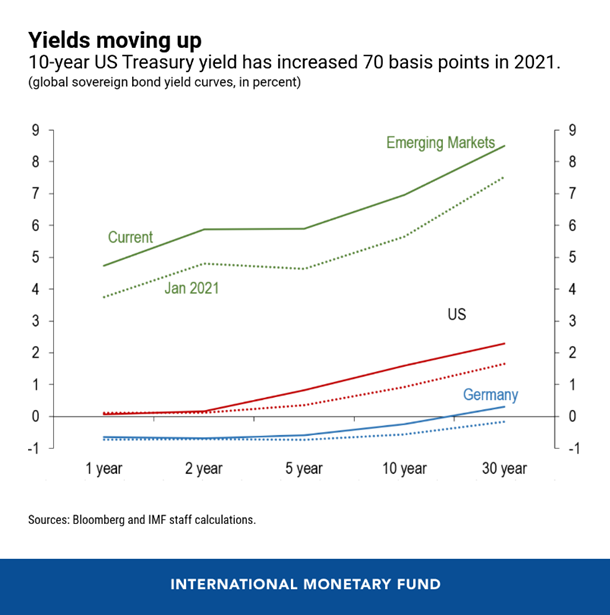

Dear maria, In today's edition we focus on investing in climate solutions and how best to tackle climate change, the effect of the pandemic on robots and inequality, the combination of high public debt and low interest rates, Central Bank Digital Currencies, a new social contract fit for the 21st century, and much more. On that note, let's dive right in. INVESTING IN CLIMATE SOLUTIONSYesterday, Managing Director Kristalina Georgieva spoke at the inaugural Leaders Summit on Climate, which was opened by U.S. President Biden and Vice President Harris. "At the IMF we look at climate change as central in our work on macroeconomic and financial stability, growth and employment. It presents huge risks to the functioning of our economies and offers incredible opportunities for transformative investments and green jobs," said Georgieva. She then focused on three areas where the right policies can make a significant difference in accelerating the transition to the new climate economy: a robust price on carbon; standardized reporting of climate related financial risks; and financial support to developing countries. First, a robust price on carbon: it provides a critical market signal to producers and consumers in all sectors of the economy. It has proven to advance investments in renewable energy, electric mobility, energy efficient buildings, reforestation and other climate friendly activities — with positive impact on growth and jobs, while reducing carbon emissions. Carbon revenues can also help secure a just transition, compensating households for price increases and helping businesses and workers move from high to low carbon intensity activities. Our analysis shows that without it, we will not reach our climate stabilization goals. It also shows that a mix of steadily rising carbon prices and green infrastructure investment could increase global GDP by more than 0.7 percent per year over the next 15 years—and create millions of new jobs. Carbon pricing is gaining momentum. Many businesses now use a shadow carbon price in their models. Over 60 pricing schemes have been implemented. But the average global price is currently $2 a ton, and needs to rise to $75 a ton by 2030 to curb emissions in line with the goals of the Paris Agreement. Because of the urgency to act we propose an international carbon price floor among large emitters, such as the G20. Focus on a minimum carbon price among a small group of large emitters could facilitate an agreement, covering up to 80 percent of global emissions. Such a price floor has to be pragmatic and equitable, with differentiated pricing for countries at different levels of economic development. And it can be implemented through carbon taxes, carbon trading systems, or equivalent measures that match local policy preferences. Crucially, a price floor could avoid less efficient and contentious border carbon adjustments if some countries move ahead with robust pricing while others do not. THE EXCHANGE: CONVERSATIONS FOR A BETTER FUTUREYesterday, MD Georgieva also hosted a one-on-one conversation with the architect of the Paris Climate Accords, Christiana Figueres. With the COP26 summit just months away, the IEA estimates global carbon emissions are surging and on course to reverse a large portion of last year’s reduction caused by the pandemic. Figueres says we have entered the decisive decade to enact the transformations necessary for a livable planet, with COP26 an important step. LOW-FOR-LONG IS NOT LOW FOREVERIn a new blog by Marcos Chamon and Jonathan D. Ostry, they dig deeper into the how and why many countries are experiencing a combination of high public debt and low interest rates. Their bottom line? It is indeed self-defeating to target a higher budgetary balance when the pandemic is not behind us. But that does not mean we should not worry about the consequences for debt paths, not least because markets may eventually worry, even if low borrowing costs now suggest those worries are far away. A prudent baseline is that borrowing costs might become significantly higher, especially for emerging market and developing economies. Then the task is to determine the fiscal policy needed to anchor expectations for a riskier future. Advanced economies with ample space may not need to worry much, but those with very high debt—where the reasons for low borrowing costs are imperfectly understood—might need to take some anchoring insurance. Emerging market and developing economies are likely to face more binding fiscal constraints and may need to adjust sooner (but again, not before the recovery is firmed up). All countries will need to anchor fiscal plans with some notion of sustainability, which can also attenuate the concern of a market repricing of risk. This is not tomorrow’s worry if fiscal space is uncertain and market expectations can turn abruptly. Laying out plans to anchor expectations should be today’s worry for all. Interested in learning more? Read the full blog here. WHAT PANDEMICS MEAN FOR ROBOTS AND INEQUALITYFrom car manufacture to self-service checkouts, we all see how automation can transform the world of work—with lower costs and higher productivity on one hand, and more precarious employment for people on the other, write Tahsin Saadi Sedik and Jiae Yoo In a new blog. "On automation But the COVID-19 pandemic added fuel to the fire. The rise in telework, for example, is hurting low-wage workers and increasing inequality. More broadly, if the pandemic accelerates the pace of automation, then we may face a jobless recovery for low-skilled workers. Our recent IMF staff research suggests that such concerns are justified." They write that as automation intensifies following COVID-19 and transforms workplaces, more workers will need to find new jobs, especially those who are less skilled. Policies to mitigate rising inequality include revamping education to meet the demand for more flexible skill sets, and lifelong learning and new training—especially for the most affected workers. A good example is Singapore’s SkillsFuture These measures may still fall short if the training involves acquiring a substantively different and challenging set of skills, raising the possibility of dropouts. It is therefore important for policymakers to consider ways to address medium-term social challenges, including through strengthened social safety nets. OVERLAPPING GLOBAL CHANGESEarlier this week, MD Georgieva delivered the opening plenary of the Boao Forum for Asia Annual Conference, honing in on three major issues: the shift from deep recession to recovery; the digital transformation that has been accelerated by the pandemic; and the pivot to low-carbon and resilient growth in response to climate change. The first is the shift from deep recession to recovery. Our most recent forecast puts global growth at 6 percent this year and 4.4 percent in 2022, thanks to the extraordinary interventions by governments, and spurred by the prospect of expanding vaccinations. But we must not take the recovery for granted—there is a dangerous divergence in economic fortunes across and within countries. So long as the crisis is with us, vulnerable households and viable firms will need continued support. As recovery takes hold, governments can gradually scale back support programs—but scale up targeted hiring subsidies and retraining and reskilling. This is particularly important for low-skilled workers, youth and women, who have borne the brunt of the crisis. The second major change is the digital transformation that has been accelerated by the pandemic. China has made great strides reshaping its own economy based on technology, and now other emerging markets are getting a push from the same digital engines. Among the economies that have the largest information and communication technology sector by share of GDP—13 of the top 30 are in the emerging world. To further seize this opportunity, governments should scale-up smart public investments—especially in the digital skills and infrastructure to build a 21st century workforce. The third major change affecting the entire world is the pivot to low-carbon and resilient growth in response to climate change. We welcome China’s commitment to reach net-zero by 2060—and other major economies are making similar pledges. The green investments needed to get there can be a quadruple win—good for people, for our planet, for growth, and for jobs. Our analysis shows a coordinated green infrastructure push combined with carbon pricing, could boost global GDP in the next 15 years by 0.7 percent per year—and create millions of jobs. THE INTERSECTION OF TECHNOLOGY AND CURRENCYIn a new interview with Central Banking, DMD Tao Zhang spoke about the Fund's perspectives on Central Bank Digital Currency operating frameworks, regulating big tech and macrofinancial oversight in a digital world. On one aspect of digital currency, for example, Zhang explains: Stablecoins have the potential to enhance the efficiency of the provision of financial services, and all the more so if they are adopted widely, across multiple jurisdictions – the ‘global stablecoins’ that people often discuss. But we agree that stablecoins, and especially those with global reach, may also generate risks, as you mention. Global stablecoins could pose significant money laundering risks, the decentralized nature of stablecoin arrangements could pose governance challenges, and stabilization mechanisms and redemption arrangements could pose market, liquidity and credit risks. To address these and other challenges, the Financial Stability Board developed 10 high-level recommendations in October 2020, with active contributions from IMF staff, and is now following up on implementation. Read the full interview here. UNDERSTANDING THE RISE IN LONG-TERM RATES"The rise in long-term US interest rates has become a focus of global macro-financial concerns. The nominal yield on the benchmark 10-year Treasury has increased about 70 basis points since the beginning of the year. This reflects in part an improving US economic outlook amid strong fiscal support and the accelerating recovery from the COVID-19 crisis. So an increase would be expected," write Tobias Adrian, Rohit Goel, Sheheryar Malik, and Fabio Natalucci in a new blog. "But other factors like investors’ concerns about the fiscal position and uncertainty about the economic and policy outlook may also be playing a role and help explain the rapid increase early in the year." They continue: Because US bonds are the basis for fixed-income pricing, and affect almost any security around the world, a rapid and persistent yield increase could result in a repricing of risk and a broader tightening in financial conditions, triggering turbulence in emerging markets and disrupting the ongoing economic recovery. In this blog, we will focus on the key factors driving the Treasury yield to help policymakers and market participants assess the interest-rate outlook and attendant risks. A gradual increase in longer-term US rates—a reflection of the expected strong US recovery—is heathy and should be welcomed. It would also help contain unintended consequences of the unprecedented policy support required by the pandemic, such as stretched asset prices and rising financial vulnerabilities. F&D: MINOUCHE SHAFIK OF LSE ON A NEW SOCIAL CONTRACTIn a new book titled What We Owe Each Other, London School of Economics and Political Science Director Minouche Shafik sets out the basis for a new social contract fit for the 21st century. "My interest in social contracts grew out of a desire to understand the underlying causes of the recent anger manifested in polarized politics, culture wars, conflicts over inequality and race, and intergenerational tensions over climate change," writes Shafik in a new article for F&D. Discontent is widespread. Four out of five people in China, Europe, India, and the United States feel that the system isn’t working for them, and in most advanced economies parents fear that their children will be worse off than they are (Edelman 2019). The pandemic served as a great revealer as it hit the most vulnerable—the old, the sick, women, and those in precarious jobs—the hardest and exacerbated existing inequalities. Most of this disaffection stems from the failure of existing social contracts to deliver on people’s expectations for both security and opportunity. Old arrangements have been broken by varied forces, including those whose overall impact on society has been positive. These include technological change, which is revolutionizing work, and the entrance of increasingly educated women into the labor market, which interferes with their ability to care for the young and the old for free. Looking ahead, population aging means that we will need to find new ways to support the elderly, and climate change compels us to work even harder to make the world environmentally sustainable. The good news, however, is that a new social contract is possible, and it depends on three pillars: security, shared risk, and opportunity. What would this mean in practice? Read the full article here. ACHIEVING THE SDGS IN SUB-SAHARAN AFRICAThe COVID-19 pandemic has considerably slowed down progress towards the Sustainable Development Goals. In that context, the IMF’s Fiscal Affairs Department and the IMF’s Africa Training Institute recently organized a regional seminar that helped policymakers in Sub-Saharan Africa identify the most effective ways to assess the spending challenge, come up with adequate financing strategies, and align policies and budgets to achieving the SDGs. Learn more from this Twitter stream. FREE ONLINE COURSES FROM THE IMFThe IMF is launching new courses in English, French, Spanish, Russian, and more, both via EdX through its massive open online courses and through its training catalogue for government officials. All courses are available free of charge. Topics include macroeconomic management in recourse-rich countries, public sector debt statistics, much more. Interested in registering for our new course on inclusive growth? You have until May 25 to register at EdX (the deadline is May 24 for government officials via our catalogue). IMF AROUND THE WORLDThe IMF Executive Board this week announced the conclusion of Article IV consultations to assess the economy of Aruba. Swift policy response helped the Caribbean island economy weather the crisis but it faces a tepid recovery in 2021. IMF staff issued a statement concluding an Article IV virtual mission to Iceland, which has favorably handled the pandemic but faces challenges given the importance of tourism to the country’s economy. Staff also announced the conclusion this week of virtual discussions with authorities in Armenia where the recovery is likely to be protracted. IMF LENDINGCheck out our global policy tracker to help our member countries be more aware of the experiences of others in combating COVID-19. We are also regularly updating our lending tracker, which visualizes the latest emergency financial assistance and debt relief to member countries approved by the IMF’s Executive Board. To date, 80 countries have been approved for emergency financing, totaling over US$32 billion. Looking for our Q&A about the IMF's response to COVID-19? Click here. We are also continually producing a special series of notes—about 100 to date—by IMF experts to help members address the economic effects of COVID-19 on a range of topics including fiscal, legal, statistical, tax and more. HAVE YOUR SAYThank you again very much for your interest in the Weekend Read. We really appreciate your time. If you have any questions, comments or feedback of any kind, please do write me a note. Sincerely, | |||

|