Dear maria, In today's edition we focus on a collective call to action to end the pandemic, how the IMF is playing a more active role in helping countries combat climate change, how the right policies can ease the pandemic's unequal impact on workers, a new F&D issue that looks at the path forward for emerging markets, and much more. On that note, let's dive right in.  A COLLECTIVE CALL TO ACTIONThe leaders of G7 nations are preparing to meet in the United Kingdom next week and will likely have an important agenda item: how to end the COVID-19 pandemic and secure the global recovery. IMF Managing Director Kristalina Georgieva joined with World Health Organization Director-General Tedros Adhanom Ghebreyesus, World Bank Group President David Malpass, and World Trade Organization Director-General Ngozi Okonjo-Iweala calling on the world to pursue a coordinated plan to vaccinate the world. The recent proposal from IMF staff puts forward a plan with clear targets, pragmatic actions, and at a feasible cost. It builds on and supports the ongoing work of WHO, its partners in the Access to COVID-19 Tools (ACT) Accelerator initiative and its global vaccine access program COVAX, as well as the work of the World Bank Group, the WTO and many others. At an estimated $50 billion, it will bring the pandemic to an end faster in the developing world, reduce infections and loss of lives, accelerate the economic recovery, and generate some $9 trillion in additional global output by 2025. Stepping up: The op-ed describes how the four institutions would contribute to the effort. The IMF is preparing an unprecedented Special Drawing Rights (SDR) allocation to boost the reserves and liquidity of its members. The WHO is seeking to identify financing so that the urgent needs of its Strategic Preparedness and Response Plan and the ACT-Accelerator partnership can be met, with COVID-19 Technology Access Pool (C-TAP) incentivizing the sharing of know-how and technology. The World Bank will have vaccine projects up and running in at least 50 countries by mid-year—with the International Finance Corporation working to mobilize the private sector to boost vaccine supply for developing countries. And the WTO is working on freeing up supply chains for the plan to succeed. Read the full op-ed here. Read a separate joint statement Georgieva and Malpass issued to the G7 calling for COVID-19 vaccine access to developing countries.  Watch a press conference featuring the heads of the IMF, World Bank, WHO, and WTO. Watch a press conference featuring the heads of the IMF, World Bank, WHO, and WTO.

ASSESSING THE RISKS OF CLIMATE CHANGEIn a speech to the annual Green Swan Conference hosted by the Bank for International Settlements, Managing Director Kristalina Georgieva dug into how the IMF is integrating climate issues into its work. The IMF has important role with the two types of assessments it is mandated to carry out regularly. Article IV consultations: These are annual or bi-annual assessments of a member country's economy and provide policy advice. In countries that are significant emitters, the focus will be on mitigation policies, she said. The top priority is to help them shape the incentive environment for public and private investments and consumer behavior—to change and shift to low-carbon intensity—and first and foremost concentrating on pricing carbon. We are looking at three ways: tax—the most efficient way to do it; trade—which has taken off and is quite popular; and also regulatory equivalency of pricing carbon—in other words, a sort of a shadow carbon price based on regulation. Financial sector surveillance: The IMF's Financial Sector Assessment Programs (FSAPs), which are conducted on 12 to 14 countries per year, will look at two kinds of risk. First, the direct physical risks of climate change. Second, the risks that transitioning to a greener economy can bring, such as how "dirty" assets are going to evolve, how their value will decline, how they will be replaced by others. In the Philippines, the FSAP looked at how low-lying islands that are hit by typhoons can manage this risk and how the authorities can model future storms, and the impact of these storms on bank capital. In Norway, a major oil exporter, the assessment looked at the transition risks and how carbon price increases would affect banks’ credit exposure. Read the MD's speech and watch the event here. OUR MOST GLOBAL CHALLENGEAlso at the Green Swan Conference, IMF Deputy Managing Director Tao Zhang laid out in a speech a "globalist view" on climate change, discussed different climate policy instruments, and how domestic policy to fight climate change can be supported internationally. Just as the COVID-19 pandemic did not respect borders, they are are even more irrelevant, however, when it comes to climate change. The national origin of greenhouse gas emissions makes absolutely no difference in terms of their impact. We all share the same atmosphere. The externality here is perfect and complete, he said. Read and watch the full speech here.  Watch Tobias Adrian, director of the IMF's Monetary and Capital Markets Department, discuss how financial stability, regulation and supervision should be considered in the context of increasing climate-related risks. Watch Tobias Adrian, director of the IMF's Monetary and Capital Markets Department, discuss how financial stability, regulation and supervision should be considered in the context of increasing climate-related risks.

Watch Ceyla Pazarbasioglu, director of the IMF's Strategy, Policy and Review Department, discuss the role of governments and international financial institutions in mitigating risks and coordinating the policy response to climate change. Watch Ceyla Pazarbasioglu, director of the IMF's Strategy, Policy and Review Department, discuss the role of governments and international financial institutions in mitigating risks and coordinating the policy response to climate change.

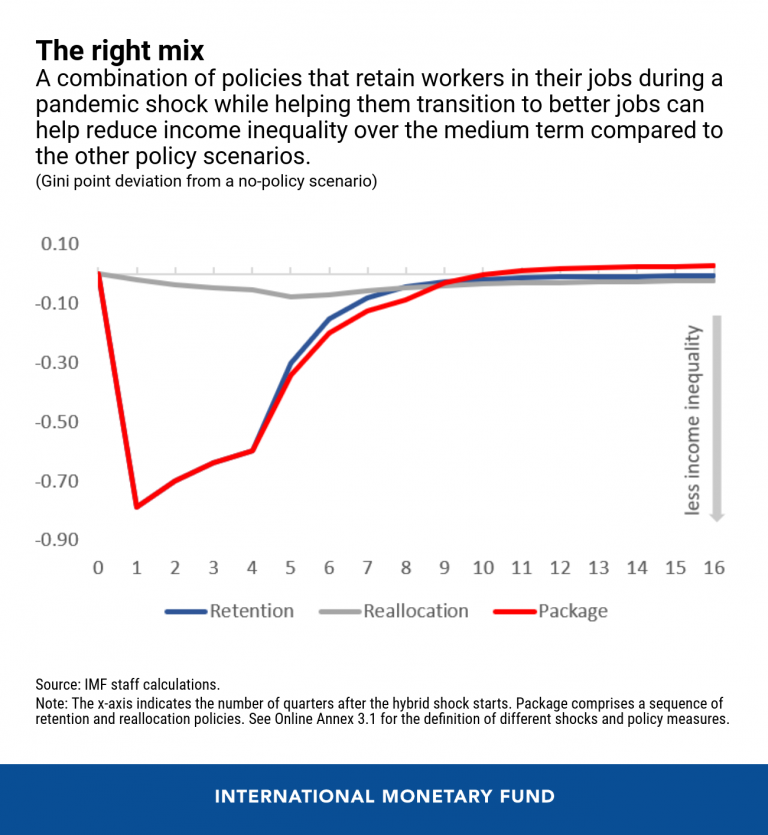

F&D: WHAT NEXT FOR EMERGING MARKETS?Our new issue of Finance & Development is out this week. In it, we look at the road ahead for emerging markets, a label frequently applied to economies in the middle—neither advanced nor low-income. Because of their growing systemic relevance, this group of countries helps anchor global stability. Yet, as we drill down and define their characteristics, we find a widely diverse set of economies of varying sizes and growth rates that face different prospects, priorities, and challenges. Among the highlights: The IMF’s Rupa Duttagupta and Ceyla Pazarbasioglu take stock, with a focus on debt, economic policy trade-offs, and priorities for stronger growth. Two leading investors, Richard House and David Lubin, discuss how emerging market assets have fared during the pandemic and why they are unlikely to suffer systemic crises as in the 1980s and 1990s. Şebnem Kalemli-Özcan, in contrast, sees the potential for greater turbulence as US interest rates rise. Francisco Ferreira shows that the pandemic’s effect on inequality is manifested in counterintuitive ways, depending on how you measure it. And 20 years after coining the acronym “BRICs,” Jim O’Neill reconsiders the diverging fortunes of Brazil, Russia, India, and China. Read the full issue here.  F&D PODCAST: MILITARY SPENDING IN THE POST-PANDEMIC ERACOVID-19 has left government budgets across the globe scrambling for revenues and having to reassess their tax and spending policies. For some countries– especially those in conflict areas, spending on defense eats up precious resources that could otherwise go toward other forms of public spending like education, health and infrastructure. In this podcast, economist Sanjeev Gupta says keeping global tensions in check would have long-term economic benefits. Listen to the podcast here. Read the accompanying article in the newest edition of F&D.  REDUCING COVID-19'S UNEQUAL EFFECT ON WORKERSLower-skilled and young workers were among the hardest hit from the pandemic, suffering job losses in record numbers last year. Some of those jobs may never reappear as economies readjust to a post-pandemic world. Longer-term changes appear likely in terms of the mix of jobs in the economy—some sectors and occupations will permanently shrink, and others will expand. With many unemployed workers still struggling to regain their pre-pandemic salaries and other fundamental shifts underway, incomes across workers are likely to diverge further, the IMF's Marina Tavares writes in a blog with Jorge Mondragon. As shown in our latest chart of the week, research from the April 2021 World Economic Outlook finds that job retention support (shown by the blue line) can more quickly reduce the rise in income inequality in the first few months after a crisis hits. When followed with support for workers to shift or reallocate to new jobs, the analysis shows that the combined, well-sequenced policy package (shown by the red line) can more effectively dampen the increase in income inequality over the medium term—as captured by the lower Gini index (a common measure of income inequality)—than if each type of policy was used alone.  MARK YOUR CALENDARWILL THE RECOVERY BE FOR EVERYONE?IMF Chief Economist Gita Gopinath will speak at the Trento Festival of Economics on June 6 at 10 AM ET. She will discuss whether the recovery from the pandemic will succeed in involving emerging countries and vulnerable groups in advanced countries and if post-pandemic debt is sustainable for everyone. Click here for more information. WOMEN AND WORKIMF African Department Director Abebe Aemro Selassie will join Betsey Stevenson, a former member of the White House Council of Economic Advisers, for a virtual discussion at the Peterson Institute for International Economics. The two will discuss whether the pandemic has undone years of progress in developed and developing countries. The event starts at 8:30 AM ET on June 8. Click here to register. IMF AROUND THE WORLDThe IMF Executive Board announced this week the conclusion of its second review under the Extended Credit Facility Arrangement with The Gambia and approved a $14.4 million disbursement. The Board also recently completed a review of Peru's performance under the Flexible Credit Line Arrangement. The Board also announced the conclusion of Article IV economic assessments of the Marshall Islands, Botswana, Italy, and Thailand. IMF staff recently announced it reached an agreement with the Democratic Republic of the Congo on a three-year, $1.5 billion financing package. The IMF and Uganda reached a staff-level agreement on a three-year, $1 billion financing package. Staff also reached agreement with Cameroon on new arrangements under the Extended Credit Facility and the Extended Fund Facility. IMF staff, during the past week, also announced the conclusion of a virtual mission to Yemen and concluded Article IV missions with Greece and Romania. RESPONDING TO THE CRISIS: To date, 86 countries have received more than $110 billion in financial assistance in response to the economic impact of the COVID-19 crisis. Find out more in our lending tracker, which visualizes the latest emergency financial assistance and debt relief to member countries approved by the IMF’s Executive Board. Overall, the IMF is currently making about $250 billion, a quarter of its $1 trillion lending capacity, available to member countries. Looking for our Q&A about the IMF's response to COVID-19? Click here. We are also continually producing a special series of notes—about 100 to date—by IMF experts to help members address the economic effects of COVID-19 on a range of topics including fiscal, legal, statistical, tax and more. HAVE YOUR SAYThank you again very much for your interest in the Weekend Read. We really appreciate your time. Please feel free to provide any feedback on our efforts to update the layout and readability of the newsletter. Sincerely, |