Dear maria, In today's edition we focus on a policy "trilemma" in Africa, the need for climate disclosure improvements, social unrest and stock markets, opportunities and risks for public-private infrastructure partnerships, how innovation has thrived during the crisis, and much more. On that note, let's dive right in.  But first, IMF Managing Director Kristalina Georgieva will participate next week in the Paris Peace Forum Spring Meeting where the focus be on helping bridge the North-South divide on critical challenges: vaccines, debt, climate. The event starts on Monday, May 17 at 11 am ET/5 pm CEST. But first, IMF Managing Director Kristalina Georgieva will participate next week in the Paris Peace Forum Spring Meeting where the focus be on helping bridge the North-South divide on critical challenges: vaccines, debt, climate. The event starts on Monday, May 17 at 11 am ET/5 pm CEST.

AFRICA'S POLICY TRILEMMA Trinity Ncube is a volunteer occupational therapist at the COVID-19 Field Hospital in Nasrec, Johannesburg. (James Oatway/IMF Photos) Imagine you’re a policymaker in sub-Saharan Africa. You’ve been charged with lifting your country out of the worst health crisis in living memory, and nobody around you knows when it will end—the second wave that gripped the region earlier in the year has eased, but many countries are nonetheless bracing for further waves as winter approaches. Even as some parts of the world seem to be moving toward recovery, near-term growth prospects for the region are somewhat more subdued. As long as widespread vaccination remains out of reach, policymakers face the unenviable task of trying to boost their economy while simultaneously dealing with repeated COVID-19 outbreaks as they arise, the IMF's Abebe Aemro Selassie and Andrew Tiffin write in a new blog. Three challenges: Many finance ministers in sub-Saharan Africa today have to overcome three obstacles--meeting increased spending needs because of the pandemic, containing a pronounced increase in public debt, and mobilizing more tax revenues. The international community can provide invaluable breathing room, but the main effort must come from within sub-Saharan Africa. Greater transparency to lift efficiency of public spending, improving tax administration, and medium-term fiscal frameworks for debt sustainability can help policymakers meet this challenge. Read the full blog here.  Watch Selassie provide an overview of the regional economic outlook for sub-Saharan Africa in this recent video. Watch Selassie provide an overview of the regional economic outlook for sub-Saharan Africa in this recent video.

INVESTING IN A GREENER FUTUREImagine that you want to invest your savings and are looking for a firm or sector with a sustainable business model or a project that can make a real difference in the transition to a low-carbon economy. Where do you get reliable information to assess and compare projects from different companies? To give investors access to decision-useful information to effectively price and manage climate risks, there is an urgent need to strengthen the “climate information architecture.” In a new blog, the IMF's Caio Ferreira, Fabio Natalucci, Ranjit Singh, and Felix Suntheim describe three building blocks to support this effort: - High-quality, reliable, and comparable data

- A harmonized and consistent set of climate disclosure standards

- A broadly agreed upon global taxonomy (classifications of assets or activities that clarify the extent to which investments are climate friendly)

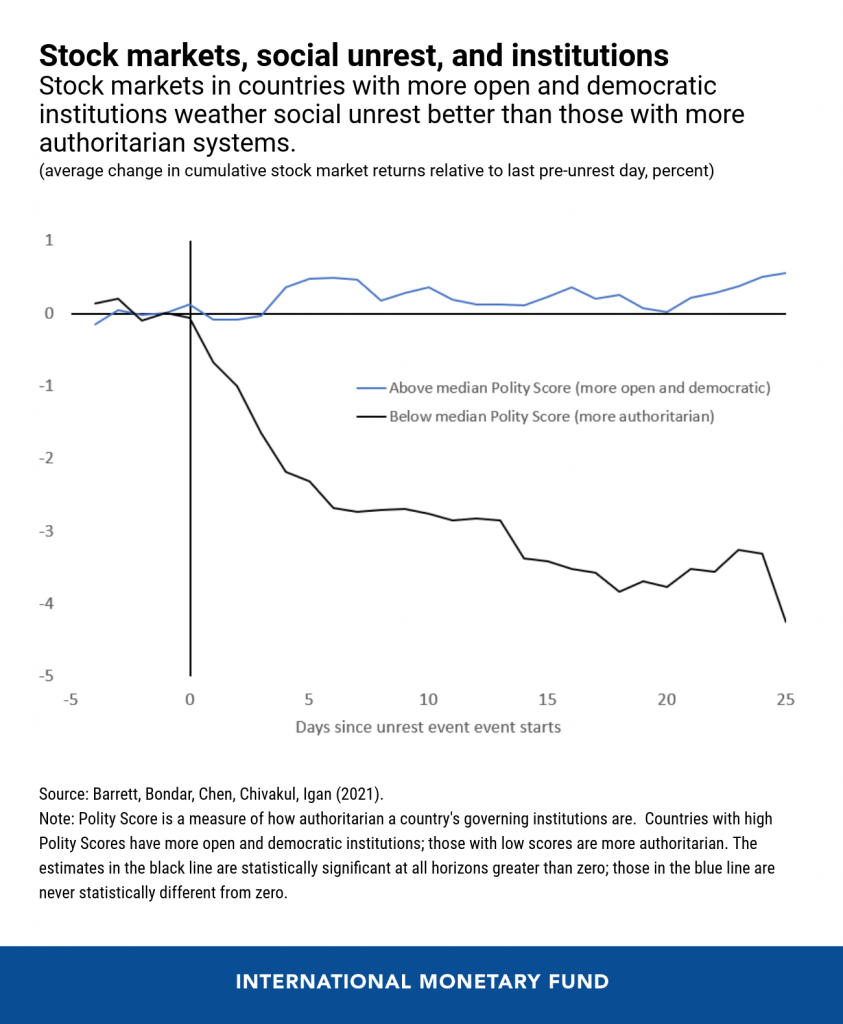

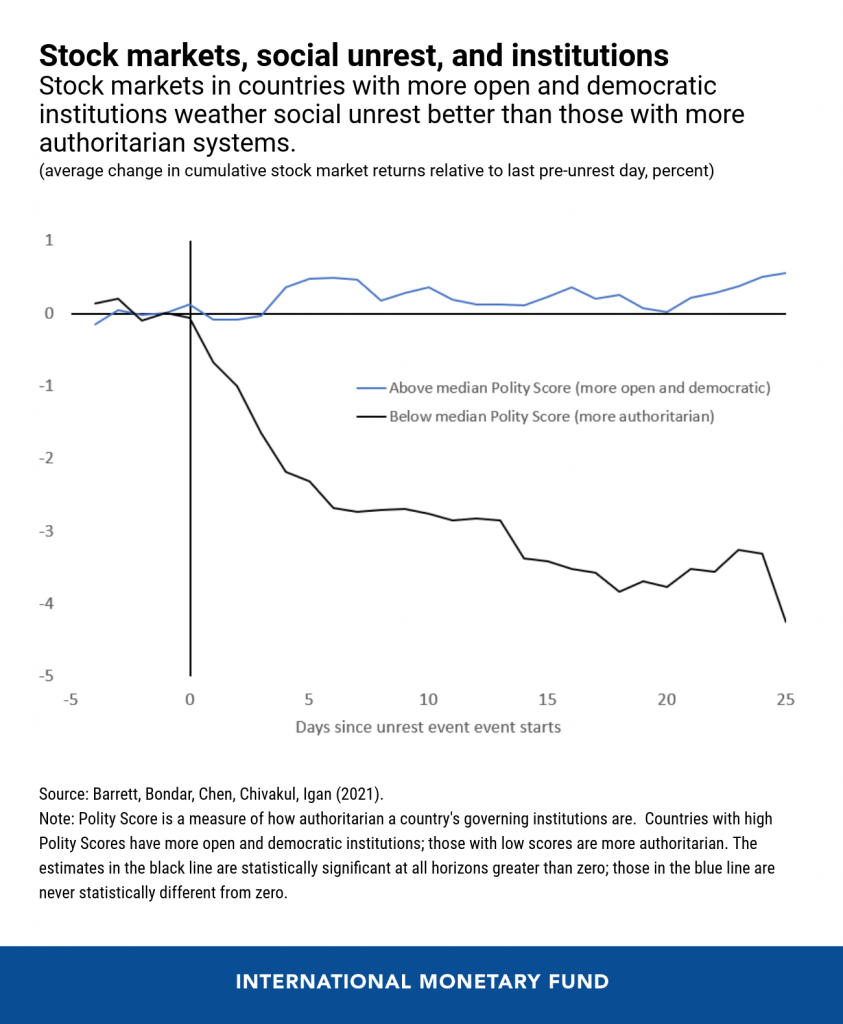

Not all companies disclose climate metrics at the same level. To make more progress, a consistent, timely, and uniform implementation of internationally agreed sustainability reporting standards is necessary. Here, strong international commitment will be needed. Read the full blog here.  STOCK MARKETS AND SOCIAL UNRESTWhat happens to stock markets when social unrest—such as mass protests and riots—occurs? Are investors scared-off by the disorder? Or are they buoyed by the prospect of positive, popular change in response to unrest? A new chart of the week blog by the IMF's Philip Barrett and Sophia Chen uses a new dataset of 156 social unrest events during 2011–20 to shed some light on these questions. It shows that in countries with more open and democratic institutions, social unrest events have a negligible impact on stock market returns (blue line). But in countries with more authoritarian regimes, the effect is large and negative: on average, stock market returns fall by 2 percent within 3 days, and by about 4 percent in the following month (black line).  RISKY BUSINESSInvestment in infrastructure could be a driving force of the economic recovery in the aftermath of the COVID-19 pandemic in the context of shrinking fiscal space. Public-private partnerships create a great opportunity in this area when carefully designed and managed. A new IMF Departmental Paper by Manal Fouad, Chishiro Matsumoto, Rui Monteiro, Isabel Rial, and Ozlem Aydin Sakrak explores how to address the risks of public-private partnerships. Public-private partnerships can bring efficiency and innovation but also higher financing costs. The authors find that enjoying the benefits of these arrangements requires governments to carefully manage the processes, including fiscal risk management considering their long-term nature and the complexity of risk-allocation

agreements. Read the full paper here. GENDER, MONEY AND FINANCEOn May 20, IMF Managing Director Kristalina Georgieva will open the first edition of the Vienna Economic Dialogue, organized by the Austrian National Bank in partnership with the IMF’s Joint Vienna Institute and the European Money and Finance Forum. The Dialogue will discuss gender-specific economic policies and how gender equality affects economic outcomes. Managing Director Georgieva will join the opening session on “gender and economic policymaking” at 2 pm CET (8 am ET) with Robert Holzmann (Governor, Austrian National Bank), Christine Lagarde (President, European Central Bank), and Claire Jones (Reporter, Financial Times). Click here to register for the event.  GROW YOUR SKILLS IN ECONOMICS AND FINANCEThe IMF currently offers 35 free and open online courses on EdX, in 5 languages. Make sure to save your spot to enhance your knowledge of key macroeconomic concepts over Summer. In addition, government officials can register on our dedicated portal – we have just extended the deadline to register to our new flagship course on inclusive growth by May 31, so we encourage you to take advantage of it. Watch our preview video here. PODCAST: BUDGETING FOR GENDER EQUITYNew IMF research shows that women with young children, mothers, particularly less educated ones, have been the most adversely affected group during the pandemic. Chrystia Freeland is Canada's Deputy Prime Minister and its first-ever female Finance Minister. In this podcast, Freeland and IMF Managing Director Kristalina Georgieva, discuss policies to help prevent the covid-19 pandemic from rolling back gains in women's economic opportunities, and how Canada has aligned its gender strategy with the budget process. Listen to the podcast of their discussion here.  IMF AFRICAN DEPARTMENT AT 60Did you know that the IMF’s African Department was created 60 years ago, on May 1, 1961? To commemorate this anniversary, President Alassane Ouattara of Côte d’Ivoire joined IMF Managing Director Kristalina Georgieva for a conversation about setting the stage of sub-Saharan Africa's post-pandemic recovery. Ouattara, who served as a former director of the IMF's African Department and IMF Deputy Managing Director, also shared how the IMF and Africa have changed.  Watch the full video here. Watch the full video here.

F&D: INNOVATING AMID CRISIS An employee displays a QR code for receiving payments through the Bahamian Sand Dollar app. (Melissa Alcena/IMF Photos) "Never let a serious crisis go to waste.” Innovators around the world are taking the saying seriously, responding to the disruption caused by the COVID-19 pandemic with creative digital solutions. The initiatives we highlight here are markedly diverse: the overnight transformation of Sri Lanka’s 125-year-old live tea auction; the world’s first central bank digital currency in The Bahamas; and the rapid pivot from a taxi-hailing app in Kampala, Uganda, to a thriving e-commerce platform. All three share a common characteristic: an innovative, entrepreneurial spirit born of an urgent need. The Bahamas "Sand Dollar" digital currency initiative responded to a need to extend financial services to residents of remote islands whose lack of access was exacerbated by extreme weather. In Sri Lanka, the tea industry—fundamental to the economy and employing millions—came to a sudden halt when COVID-19 prohibited the weekly tea auction from convening. And in Uganda, people’s ability to get food and medicine and earn an income was severely hampered by the pandemic lockdown. Interested in learning more? Read the full article (and watch three stunning video stories) here, download the PDF. IMF AROUND THE WORLDIMF staff reached a staff-level agreement with Barbados on the fifth review of the Barbados’ Economic Recovery and Transformation program (BERT) supported by the Extended Fund Facility. A staff mission to Zambia also continued discussions with the authorities during April-May on their request for an Extended Credit Facility. IMF staff also concluded Article IV economic assessment missions for Singapore, Mauritius, Denmark, and Ireland. Staff also announced the conclusion of a mission for a staff-monitored program to Guinea Bissau. IMF Managing Director Kristalina Georgieva also welcomed the IMF Executive Board's approval of a financing plan for Sudan. RESPONDING TO THE CRISIS: To date, 86 countries have received more than $110 billion in financial assistance in response to the economic impact of the COVID-19 crisis. Find out more in our lending tracker, which visualizes the latest emergency financial assistance and debt relief to member countries approved by the IMF’s Executive Board. Overall, the IMF is currently making about $250 billion, a quarter of its $1 trillion lending capacity, available to member countries. Looking for our Q&A about the IMF's response to COVID-19? Click here. We are also continually producing a special series of notes—about 100 to date—by IMF experts to help members address the economic effects of COVID-19 on a range of topics including fiscal, legal, statistical, tax and more. HAVE YOUR SAYThank you again very much for your interest in the Weekend Read. We really appreciate your time. Please feel free to provide any feedback on our efforts to update the layout and readability of the newsletter. Sincerely, |