Dear maria, In today's edition we focus on Special Drawing Rights, trade's role in the recovery, the IMF's climate approach, climate change in Asia, sovereign debt challenges, keeping European banks healthy, China's recovery, African debt, financial inclusion, and much more. On that note, let's dive right in.  But first, our IMF-World Bank Spring Meetings are coming up in April (agenda here)—if you haven’t already, subscribe to our special 6-day briefing by clicking here and pressing send. It's that easy. But first, our IMF-World Bank Spring Meetings are coming up in April (agenda here)—if you haven’t already, subscribe to our special 6-day briefing by clicking here and pressing send. It's that easy.

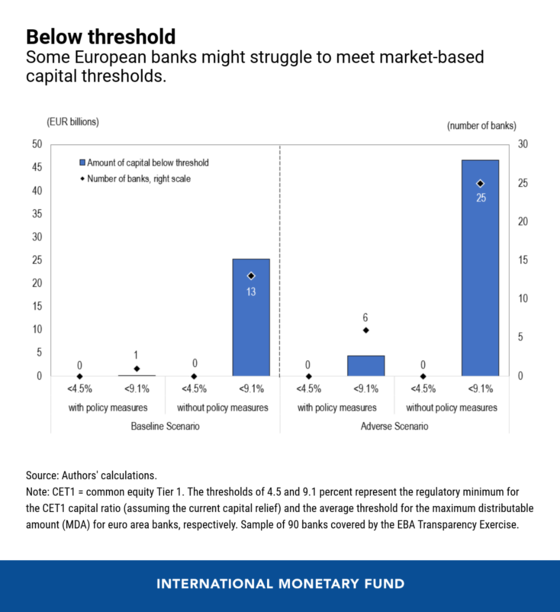

SDR ON THE IMF EXECUTIVE BOARD AGENDAThe IMF's Executive Board this week conveyed broad support for the general allocation of Special Drawing Rights (SDR) of $650 billion. The move would provide additional liquidity to the global economic system by supplementing the reserve assets of the Fund’s 190 member countries. An SDR is an international reserve asset created by the IMF to supplement the official reserves of its member countries. "By addressing the long-term global need for reserve assets, a new SDR allocation would benefit all our member countries and support the global recovery from the COVID-19 crisis," IMF Managing Director Kristalina Georgieva said after the board concluded an informal discussion on the matter. What's next? The MD will present by June a formal proposal to the Executive Board to consider the allocation, which is based on an assessment of IMF member countries' long-term global reserve needs. Work to be done: IMF staff are developing new measures to enhance transparency and accountability in the use of SDRs while preserving the reserve asset characteristic of the SDR. In parallel to the formal allocation process, staff will also explore options for members that are stronger financially to reallocate their SDRs to support vulnerable and low-income countries. The new options being explored by staff to help SDRs go to countries in need would bolster efforts already being taken by richer countries to transfer SDRs to help poorer member countries. Many countries in the current crisis have already used a portion of their SDRs to expand the IMF's concessional financing by scaling up the Poverty Reduction and Growth Trust loan resources. In fact, two-thirds of the roughly $24 billion of the PRGT's fast track loan mobilization round launched last spring came from the use of existing SDRs. More on SDRs: Want to know more about SDRs and why they are important? Click here to access more IMF resources on SDRs including a recent Q&A on the topic. Hear IMF Communications Director Gerry Rice answer questions about SDRs during his weekly press briefing. TRADE'S ROLE IN THE RECOVERYMD Kristalina Georgieva joined World Trade Organization Director-General Ngozi Okonjo-Iweala in reinforcing the importance of trade to the global effort to fight the COVID-19 pandemic and recover towards a greener, more inclusive and digital future. "Unleashing the full power of trade to fight the pandemic is a moral and it is an economic necessity," Georgieva said at this week's WTO Aid-for-Trade Stocktaking event, which also featured UN Conference on Trade and Development Secretary-General Isabelle Durant, World Health Organization Director-General Tedros Adhanom Ghebreyesus, Organization for Economic Cooperation and Development Secretary-General Angel Gurría, and World Bank President David R. Malpass. Global trade in 2020 declined by 9.6 percent but trade volumes are expected to grow 8.5 percent in 2021 and 6.5 percent in 2022. "Trade will be at the heart of efforts to build forward toward a greener, more inclusive and digital recovery. We are going to experience structural shifts to the new climate economy. It will depend on the exchange of goods and services," the MD said. Why it matters: Ngozi said least developed countries were hit hardest by the fall in trade. Ramping up vaccine manufacturing and trying to use existing capacity will be especially important for developing economies while minimizing trade bottlenecks and barriers. All of this should happen concurrently with WTO member discussion over a possible intellectual property waiver that could open vaccine production to more manufacturers. Ngozi noted that production of the Pfizer-BioNTech vaccine requires 280 components manufactured in 19 countries. "If in one country or one place there should be a blockage on some component this is going to hold up the scaling of production of that vaccine all over the world," she said. Watch the full event here. THE IMF'S NEW CLIMATE APPROACHMD Georgieva this week laid out how the IMF is moving forward with work that will further link climate risks to financial stability. That includes incorporating climate in the IMF's annual country assessments, known as Article IV reports. The IMF is set to do 70 of those assessments this year and next, the MD said at the Investing in Climate Action event hosted by Project Syndicate with the European Commission and European Investment Bank. Making news: "The IMF is well-known for the credibility of its data," she said. "What we are now doing, and I’m very proud to announce it in this discussion, we are moving toward integrating climate indicators, more specifically carbon intensity indicators, in our quarterly, mainstream macroeconomic performance reports." Makings sure countries are well informed on the right policies, financial support, and making a credible push on the financial system to integrate climate-related risks are three ways the IMF is establishing itself as a "systemically significant institution in the transition to the new climate economy," she said in a discussion with European Investment Bank President Werner Hoyer and UN Development Programme Administrator Achim Steiner. Watch the full event here with the MD's appearance starting around the 3 hour 23 minute mark. ASIA'S CLIMATE CHANGE CHALLENGEClimate issues in Asia-Pacific are measured in superlatives. The world’s biggest population. Two of the three largest carbon dioxide-emitting countries and the largest share of emissions globally. The most exposed to extreme weather events. Some of the smallest and most vulnerable countries. Also, the fastest-growing part of the global economy and many of the leaders in green technology. What Asia does to fight global warming will be literally felt across the whole planet, the IMF's Vitor Gaspar and Chang Yong Rhee write in a new blog. Three things: What policies are needed? The blog outlines three areas where action can be taken. 1. More carbon taxes, more compensation -- Taxes on the carbon dioxide released when burning fossil fuels can be a highly effective way of reducing emissions, but they are little used in the region. Even a gradually introduced and relatively modest carbon tax of $25 per ton would achieve the region’s aggregate Paris Agreement target. But Asia’s Paris targets, like other region’s, are well below what is needed and models suggest that $50-100 per ton is required globally to keep warming below 2 degrees. Targeting the most polluting fuels and compensating people affected by higher energy prices is an important part of the strategy 2. Increase adaptability to climate change -- Low-income and Pacific island countries are particularly vulnerable and need to invest in protecting infrastructure, making water resources more resilient, adapting dryland agriculture, restoring mangroves, and improving early warning systems for natural disasters. But some of the most vulnerable have the least resources to prepare. Adaptation requires stepping up public investment, on average by about 3 percent of GDP annually. 3. Greener recovery from COVID-19 -- Recovery spending can be allocated towards greener activities. Some countries are already doing that, like Korea in its Green New Deal. But much more can be done as the pandemic response shifts from crisis containment to recovery. Countries seeking to accelerate the transition to carbon neutrality can invest in renewable energy, retrofitting buildings, upgrading the electricity grid, facilitating electric cars, and incentivizing research. Read the full blog here. Watch Vitor Gaspar talk about the need for a global agreement on a carbon price floor during an event on Carbon Border Adjustments for Climate hosted by the French government. SOVEREIGN DEBT AND INTERNATIONAL REFORMAs part of the WTO's Aid-for-Trade discussion, the IMF this week hosted a panel on sovereign debt challenges and reform of the international debt architecture The COVID-19 pandemic has pushed external debt levels to record highs in many countries. According to the joint IMF-World Bank Debt Sustainability Framework, over half of low-income countries are at high risk of, or already face, debt distress. The session examined the economic challenges that high debt poses for many countries, emphasizing how the pandemic has exacerbated these challenges. The panel included the IMF's Ceyla Pazarbasioglu and Guillaume Chabert; Senegal's Minister of the Economy, Planning and International Cooperation, Amadou Hott; World Bank Chief Economist Carmen Reinhart; and Chairman of the Paris Club, Emmanuel Moulin. Watch the full event here. KEEPING EUROPEAN BANKS HEALTHYA robust post-COVID-19 recovery will depend on banks having sufficient capital to provide credit. While most European banks entered the pandemic with strong capital levels, they are highly exposed to economic sectors hit hard by the pandemic, the IMF's Mai Chi Dao, Andy Jobst, Aiko Mineshima, and Srobona Mitra write in a new blog. A new IMF study assesses the impact of the pandemic on European banks’ capital through its effect on profitability, asset quality, and risk exposures. The approach differs from other recent studies—by the European Central Bank and European Banking Authority—because it incorporates policy support provided to banks and borrowers. It also incorporates granular estimates of corporate sector distress, and examines a larger number of European countries and banks. The analysis finds that, while the pandemic will significantly deplete banks’ capital, their buffers are sufficiently large to withstand the likely impact of the crisis. And with the right policies, banks will be able to support the recovery with new lending. Read the full blog here. GLOBAL ECONOMY 2021: PROSPECTS AND CHALLENGESFirst Deputy Managing Director Geoffrey Okamoto at the China Development Forum highlighted China's recovery as the country has returned to pre-pandemic growth levels. But he also said that growth still lacks balance, with private consumption lagging investment. Consumption is expected to catch up as investment growth normalizes but significant risks remain. Policies for the future: The best policies will be those that support the recovery, help strengthen resilience, and tackle long-standing challenges. For example, foster the transition to green energy and digitalization. He noted that policies announced during China's “Two Sessions” meetings to strengthen high-quality growth, rein in carbon emissions, and improve energy efficiency should support China’s quest to rebalance its growth model towards greener and more consumption-oriented growth. "Achieving faster and higher-quality growth requires mutually enhancing reforms: strengthening social safety nets and green investment; opening up of domestic markets; continuing to reform state companies; and ensuring that private and government-owned firms can compete on an equal basis," he said. Read the full speech here. IMF CAPACITY DEVELOPMENT DURING THE CRISISThe deputy director of the IMF’s Institute for Capacity Development, Roger Nord, joined the Ideagen’s Global Leadership Summit to explain how IMF Capacity Development has provided assistance to nearly all IMF member countries on crisis response, protecting the most vulnerable, and building a strong and lasting recovery. In particular, the IMF has been working with tax administrations and budget offices in many countries to help them restore operations (including through digital platforms) and strengthen support to businesses and individuals, without compromising safeguards and accountability. Nord added that the IMF is concerned about the impact of the pandemic crisis on countries’ ability to achieve the Sustainable Development Goals. That’s why the IMF has launched a COVID-19 crisis capacity development initiative to meet the surge in demand for technical assistance and training seeking to put in place institutions and policies that deliver on those objectives. Watch the event here. PODCAST: AFRICA'S DEBT COMPLICATES RECOVERYJason Rosario Braganza, Executive Director for the African Forum and Network for Debt and Development (AFRODAD), says countries countries need more fiscal space to boost social protection systems, provide stimulus for businesses, and create resources for vaccination procurement and rollout programs. Earlier this month, Braganza was invited to participate in the IMF and European Commission's annual African Fiscal Forum, where Finance Ministers, heads of international agencies, and development partners discussed ways to support African economies through the pandemic. Listen to the full podcast here. F&D: HOW CAN FINTECH BE (MORE) INCLUSIVE?In our Spring 2021 issue of F&D on the digital future, Jon Frost, Leonardo Gambacorta and Hyun Song Shin of the Bank for International Settlements write that for technology to benefit everyone, private sector innovation needs to be supported by public goods. Digital technology is transforming the financial industry, changing the way payments, savings, borrowing, and investment services are provided and who provides them. Fintech and Big Tech companies now compete with banks and other incumbents across a range of markets. Meanwhile, digital currencies promise to transform the heart of finance: money itself. But just how much has technology advanced financial inclusion, and how should policymakers adapt to this brave new world? The answer: Read the full 1800-piece here, download the PDF, or continue reading the full article below for your convenience. IMF AROUND THE WORLDThe Executive Board this week took action to temporarily extend measures that have raised the amount of financing countries can receive under the IMF's emergency lending instruments, the General Resources Account, and the Poverty Reduction and Growth Trust. The Board also concluded Article IV economic assessments of Samoa, Bahrain, Peru, Colombia, Sweden, and South Korea. The Board also completed the combined second through fifth reviews of the Extended Arrangement under the Extended Fund Facility (EFF) for Pakistan, allowing for an immediate purchase equivalent to about $500 million for budget support. The board also reviewed actions and data revisions Pakistan will take after a noncomplying purchase and a breach of obligations. For Somalia, the Board granted additional interim assistance to the east African country under the enhanced Heavily Indebted Poor Countries (HIPC) Initiative in an amount of about $0.97 million. This interim assistance will cover Somalia’s debt service obligations to the Fund for the period March 25, 2021 through March 24, 2022. Barbados has implemented the recommendations of the IMF’s Enhanced General Data Dissemination System (e-GDDS) by publishing essential data through the National Summary Data Page (NSDP). IMF staff this week concluded an Article IV mission with the Marshall Islands and issued a concluding statement for an Article IV mission to Slovenia. The IMF mission team to Argentina also issued a statement after discussions with Argentina’s Economy Minister Martin Guzmán and his team this week on an economic plan that could be backed by a new IMF-supported program. IMF LENDINGCheck out our global policy tracker to help our member countries be more aware of the experiences of others in combating COVID-19. We are also regularly updating our lending tracker, which visualizes the latest emergency financial assistance and debt relief to member countries approved by the IMF’s Executive Board. To date, 80 countries have been approved for emergency financing, totaling over US$32 billion. Looking for our Q&A about the IMF's response to COVID-19? Click here. We are also continually producing a special series of notes—more than 50 to date—by IMF experts to help members address the economic effects of COVID-19 on a range of topics including fiscal, legal, statistical, tax and more. HAVE YOUR SAYThank you again very much for your interest in the Weekend Read. We really appreciate your time. If you have any questions, comments or feedback of any kind, please do write me a note. Sincerely, |