| | Benin |

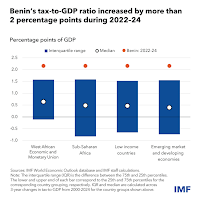

(Credit: Hadynya/iStock by Getty Images) Read this article in French Benin faced a number of negative spillovers in 2022: a deteriorating regional security situation at its northern border, the lingering scars of COVID-19, and higher living costs amid the war in Ukraine. To help counter those headwinds, the country tapped IMF support, including a $650 million blended Extended Fund Facility (EFF) and Extended Credit Facility (ECF) arrangement, complemented by a $200 million Resilience and Sustainability Facility (RSF) in 2023. Development partners’ confidence in the country’s reform program has been reflected in budget support consistently exceeding expectations. Moreover, Benin was among the first countries to re-access the international capital market last year, following a two-year hiatus, with several sovereign credit rating upgrades in recent years. Despite challenges, there are promising signs of economic transformation. Among other achievements, growth has been strong, fiscal adjustment is proceeding while allowing for a significant increase in social spending, and efforts to strengthen governance are gaining ground. Following the combined Fifth Review of the ongoing EFF/ECF arrangement and Second Review of the RSF, IMF Country Focus discussed the country’s economic performance with Romuald Wadagni, Senior Minister of State of Economy and Finance for Benin, and Constant Lonkeng, IMF Mission Chief for Benin. How is the current reform program affecting the daily lives of Beninese people? Finance Minister Wadagni: First and foremost, our ongoing reform program has allowed us to navigate an episode of severe and repeated shocks, with technical and financial support from our development partners. As a result, our economy has shown remarkable resilience, with growth averaging more than 6.5 percent in recent years. Economic resilience is helping harness the potential of Benin’s people. A key focus of our reform program is enhancing human capital, as articulated under our people-centric Government Action Program (PAG 2021–26). Our Integrated School Feeding Program currently provides free meals to students in 95 percent of elementary schools in rural areas (more than 1.3 million children), with full coverage targeted this year. Lower education is now tuition-free for girls across all of Benin’s 77 communes (estimated 2 million girls), with an ongoing pilot to extend to upper secondary school. We are also putting emphasis on technical education and vocational training to prepare our large youth population to seize job opportunities in high value-added activities. More broadly, our flagship Insurance for Human Capital Enhancement (ARCH) seeks to foster social resilience through various programs including micro-credits, access to healthcare, and pensions. The social registry—established early on under the EFF/ECF with World Bank technical support—is an essential tool for targeting our support to the most vulnerable. How has IMF engagement supported the authorities’ policy agenda? IMF Mission Chief Lonkeng: One key design consideration of Benin’s IMF-supported program was balancing financing and fiscal adjustment in a shock-prone environment. Considering Benin’s established track record in macroeconomic management, we opted for a flexible design—a vote of confidence from the IMF. Frontloaded financing supported the country’s appropriately strong counter-cyclical policy response to severe shocks—the IMF disbursed more than 40 percent of the total financing envelope of about 400 percent of Benin’s quota in the first 6 months of the 42-month program to smooth out fiscal adjustment. The EFF/ECF was subsequently complemented by an RSF (120 percent of Benin’s quota) to help enhance the country’s overall socio-economic resilience. The authorities have since been re-building policy space, with domestic revenue mobilization being a key part of this effort and, more broadly, the cornerstone of the authorities’ reform program. A frontloaded tax policy reform under the program complemented efforts to digitalize the tax system to boost revenue collection. As the chart shows, Benin’s tax-to-GDP ratio increased by more than 2 percentage points during 2022–24, far exceeding the average improvement of other countries in this timeframe.  There are promising signs of economic transformation. How are you achieving this and what lessons did you learn along the way? Finance Minister Wadagni: We first conducted an in-depth diagnostic of our economic and financial situation about a decade ago. We then embarked on a first wave of reforms to lay the foundations for structural transformation, cognizant of the fact that sound public finances, reliable energy, and infrastructure—including digital—are key prerequisites for sustained economic expansion. The ongoing second wave of reforms seek to consolidate our initial achievements and climb up value chains by processing commodities locally. The Glo-Djigbé Industrial Zone—which is dedicated to the local transformation of agricultural products including cotton, cashews, and soybeans—plays a strategic role in this regard. We intend to further develop the zone and, more broadly, pursue the structural transformation of our economy, including through continued modernization and enhanced resilience of agriculture. We will also step up investment in unlocking Benin's tourism potential and modernizing the Port of Cotonou. In doing all of the above, we will expand the social safety nets to reach as many vulnerable people as possible. A key lesson from our experience so far is that sound governance is critical in economic transformation. Benin innovated with the issuance of the first Social Development Goal (SDG) bond in the region – and is now extending this framework to catalyze private climate finance. Can you elaborate? Finance Minister Wadagni: We developed an SDG bond framework around the country’s social and climate priorities as an integral part of our development finance strategy. The framework was initially used to issue a €500 million SDG bond in 2021, a first in the region. It has since facilitated the financing of key social and energy transition projects. We intend to leverage the SDG bond framework to catalyze financing for climate change adaptation, resilient agriculture, sustainable ecosystem management, and the energy transition. Relatedly, we secured climate financing pledges from our partners during the recent COP29, following the climate finance roundtable that we co-convened in Cotonou with the IMF and the World Bank. What has been the key to program engagement in your view, and what do you see as the main challenges ahead? IMF Mission Chief Lonkeng: First and foremost, program ownership has been key. Benin has an established tradition of public consultation around the country’s reform agenda—under the National Development Plan and the Government Action Program. The Fund-supported program therefore had a solid homegrown foundation to build on. Going forward, continued expansion of the tax base, drawing on the country’s recently developed medium-term revenue strategy, would help fund Benin’s large development needs (the country’s median age is 18), and improve the country’s capacity to carry debt and preserve debt sustainability. On the structural front, a continued move away from the traditional transit-centered growth model—supported by a balanced social contract—would foster private sector job creation in higher value-added activities for the large youth population. Enhancing resilience to climate change and maintaining the digitalization drive would also support overall socio-economic resilience in the long-term. All of this would help raise the living standards of the Beninese in a sustained and inclusive manner. RELATED LINKS |